November 16, the Japan Cabinet Office (JCO) indicates, on a preliminary basis, that the country's real GDP diminished by 0.2% during this year second and third quarters. Some economists and journalists conclude that the japanese economy is again in recession, because real GDP decreased for two consecutive quarters.

December 8, the JCO publishes its revised data on GDP. The slowdown in the second quarter is now estimated at 0.1%, and the decrease in the third is erased and replaced by an increase of 0.3%.

This makes obvious again the fragility and the weakness of seeing the occurrence of a recession by using uniquely the real GDP changes, especially when the variations are small and subject to revisions.

Comments on leading indicators and the economic outlook, this is what you will mainly read in my blog.

Tuesday, December 8, 2015

OECD area: stable growth in the coming months

Leading economic indicators from the OECD point to stable growth in the coming months for the area as a whole. The increase in economic activity should be close to the trend. Canada, Japan and the euro zone are examples of economies where growth will be stable and close to trend according to data published December 8 by the OECD. But, there are signals of weakening growth for the United States and United Kingdom.

Details at:

http://www.oecd.org/std/leading-indicators/CLI-Dec15.pdf

Details at:

http://www.oecd.org/std/leading-indicators/CLI-Dec15.pdf

Thursday, December 3, 2015

The World Economy Improved in November, according to PMI Data

The world economy growth accelerated in November, according to the J.P. Morgan Global Manufacturing & Services PMI, published December 3 by Markit Economics. The increase in new orders is a positive signal for the economic activity in the coming months.

https://www.markiteconomics.com/Survey//PressRelease.mvc/5f068a9fea394b848e7b519e1f536d6f

https://www.markiteconomics.com/Survey//PressRelease.mvc/5f068a9fea394b848e7b519e1f536d6f

Thursday, November 19, 2015

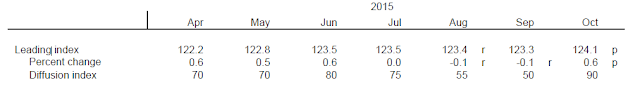

United States economy: rebound of the leading indicators in October

The Conference Board Leading Economic Index for the United States increased significantly in October, after three consecutive months of stagnation, according to the information published November 19. Moreover, nine out of ten indicators of the index contributed to the increase.

Details at:

https://www.conference-board.org/data/bcicountry.cfm?cid=1

Conference Board LEI recent evolution

Details at:

https://www.conference-board.org/data/bcicountry.cfm?cid=1

Conference Board LEI recent evolution

Tuesday, November 17, 2015

Modest growth in Quebec in the coming months

The Desjardins Leading Index (DLI) points to a modest growth of the economic activity in Quebec for the time being and in the coming months. The DLI stagnated in September and its July and August progression was revised downward, according to the information published November 16 on Desjardins Internet page.

https://www.desjardins.com/ressources/pdf/ipd1115e.pdf?resVer=1447698715000

https://www.desjardins.com/ressources/pdf/ipd1115e.pdf?resVer=1447698715000

Wednesday, November 4, 2015

World Economy: Modest Pace of Growth

The most recent JPMorgan Global Manufacturing & Services PMI, published November 4 on Markit Economics Internet site, lets believe that the world economy pace of growth is quite modest actually.

Link to Markit Economics:

http://www.markiteconomics.com/Survey//PressRelease.mvc/a903e72174024a78bf731053d96077e3

Link to Markit Economics:

http://www.markiteconomics.com/Survey//PressRelease.mvc/a903e72174024a78bf731053d96077e3

Thursday, October 22, 2015

Growth slowdown in the United States

The Chicago Fed National Activity Index and monthly leading indicators from the Conference Board and the OECD all show that the pace of growth in the United States is slowing down and that this trend will continue in the coming months.

CFNAI:

https://www.chicagofed.org/publications/cfnai/index

Conference Board:

https://www.conference-board.org/pdf_free/press/US%20LEI%20-%20Tech%20Notes%20Oct%2022%202015.pdf

OECD:

http://www.oecd.org/std/leading-indicators/CLI-Oct15.pdf

CFNAI:

https://www.chicagofed.org/publications/cfnai/index

Conference Board:

https://www.conference-board.org/pdf_free/press/US%20LEI%20-%20Tech%20Notes%20Oct%2022%202015.pdf

OECD:

http://www.oecd.org/std/leading-indicators/CLI-Oct15.pdf

Tuesday, October 13, 2015

Quebec economy: modest to moderate growth in the coming months

The recent evolution of the Desjardins Leading Index (DLI) lets believe that Quebec economy expands now at a pace going from modest to moderate, and that it will follow a similar trend in the coming months. The most recent data and analysis on the DLI were published October 13.

Thursday, October 8, 2015

Slower growth in the OECD area in the coming months

Monthly leading indicators published October 8 by the OECD point to slower growth in the coming months in that area, but the euro zone economic outlook should be stable.

Source: http://www.oecd.org/std/leading-indicators/CLI-Oct15.pdf

Source: http://www.oecd.org/std/leading-indicators/CLI-Oct15.pdf

Tuesday, September 8, 2015

World economy: its growth is weaker than expected

Three reliable sources show that the world economy grows at a slower pace than what was expected a few months ago, and that this trend could continue in the coming months:

OECD September 8 news release on composite leading indicators:

http://www.oecd.org/std/leading-indicators/composite-leading-indicators-cli-oecd-september-2015.htm

IMF staff briefing note in preparation to the September 4-5 G-20 meeting:

http://www.imf.org/external/np/g20/090415.htm

Markit Economics September 3 press release on the J.P. Morgan Global Manufacturing & Services PMI:

http://www.markiteconomics.com/Survey//PressRelease.mvc/8ae9460470fc42aa85ed4b394308f420

OECD September 8 news release on composite leading indicators:

http://www.oecd.org/std/leading-indicators/composite-leading-indicators-cli-oecd-september-2015.htm

IMF staff briefing note in preparation to the September 4-5 G-20 meeting:

http://www.imf.org/external/np/g20/090415.htm

Markit Economics September 3 press release on the J.P. Morgan Global Manufacturing & Services PMI:

http://www.markiteconomics.com/Survey//PressRelease.mvc/8ae9460470fc42aa85ed4b394308f420

Scenario of slow growth for Canada

Thursday, July 23, 2015

United States economy: moderate growth in the coming months

The american economy should grow at a moderate pace until the end of this year, according to the recent evolution of the Conference Board Leading Economic Index for that country.

US real GDP grew at approximatively 2.5% (annual rate) during the second quarter and stagnated in the first (-0.2% annual rate).

Link to the Conference Board Internet page:

https://www.conference-board.org/data/bcicountry.cfm?cid=1

July 30 update:

US real GDP growth for the second quarter is estimated at 2.3% (annual rate) according to data released today by the Bureau of Economic Analysis. The first quarter was revised to 0.6% growth.

US real GDP grew at approximatively 2.5% (annual rate) during the second quarter and stagnated in the first (-0.2% annual rate).

Link to the Conference Board Internet page:

https://www.conference-board.org/data/bcicountry.cfm?cid=1

July 30 update:

US real GDP growth for the second quarter is estimated at 2.3% (annual rate) according to data released today by the Bureau of Economic Analysis. The first quarter was revised to 0.6% growth.

Tuesday, July 21, 2015

Quebec economic outlook: slight improvement, according to the DLI

The Desjardins Leading Index (DLI) increased by 0.3% in May, like in March, but it stagnated in April, according to the analysis published July 21 on Desjardins' Internet page. The DLI evolution suggests a slight improvement for Quebec's economy in the coming months. Quebec real GDP by industry stagnated last February and contracted in March (-0,1%) and April (-0,4%), according to l'Institut de la statistique du Québec.

Link to the DLI analysis:

http://www.desjardins.com/ressources/pdf/ipd1507-e.pdf?resVer=1437502331000

Link to the DLI analysis:

http://www.desjardins.com/ressources/pdf/ipd1507-e.pdf?resVer=1437502331000

Monday, June 8, 2015

Is the Stock Market a Leading Economic Indicator?

Paul A. Samuelson wrote in 1966: “The stock market has predicted nine of the last five recessions”. But the eminent economist sarcasm was not sufficient to end that indicator reliability as a leading indicator of business cycles turning points.

To be retained as a leading indicator, a variable must have a significant importance in the economy. It must also pass the test of time: having historically demonstrated that it precedes by a few months the economic cycle peaks and troughs. Stock prices, even if they fluctuate for many reasons, seem to satisfy those conditions for many economies.

At the OECD, stock market indexes are recognized as one of the leading indicators for 27 of the 39 countries for which this organization calculates monthly composite leading indicators. The Conference Board publishes monthly leading economic indexes for 12 countries and the euro area; only the index for China does not include the stock market as a leading indicator. The Japan Cabinet Office, the Conference Board of Canada and Desjardins also retain stock prices as a leading indicator respectively for Japan, Canada and Quebec economies.

Moreover, the

authors of box 1.3 of the IMF September 2011 World Economic Outlook ask the following question: “Are Equity Price Drops Harbingers of Recession?” To

answer it, they looked at the G7 countries. Their methodology and their analysis

showed that for the United States, the United Kingdom, France and Japan, “… from the first quarter of 1970 through the first half of 2011, …real

equity prices in these economies are useful predictors of recessions.” They add: “For Canada and

Germany, there is no evidence that equity prices aid in predicting recessions,

whereas for Italy, their predictive power is consistently superseded by the

inclusion of additional financial market variables.” The authors conclude that: “These

findings suggest that policymakers should be mindful of sharp drops in equity

prices because they are associated with an increased risk of a new recession.”

Then, even if they are not infallible, stock prices indexes are

legitimate leading indicators for many economies.

Link to the OECD list of leading indicators by country: http://www.oecd.org/std/leading-indicators/CLI-components-and-turning-points.pdf

Link to the Conference Board Internet section on leading economic indicators:

http://www.conference-board.org/data/bci.cfm

Link to the September 2011 IMF World Economic Outlook:

http://www.imf.org/external/pubs/ft/weo/2011/02/

Thursday, May 14, 2015

Euro Area : the recovery gets traction

The recovery is well engaged in the euro area. Eurostat indicated May 13 that the economy continued to grow during the first quarter of 2015. Its real GDP increased by 0.4%, an heighth consecutive quarter of growth. Moreover, the Purchasing Manager Index (PMI) for the area shows that the economy continued to expand last April. Leading indicators from the Conference Board and the OECD point to the continuation of the recovery in the coming months.

Tuesday, May 12, 2015

OECD leading indicators: moderate growth for the world economy in the coming months

The OECD composite leading indicators, published May 12, point to a "positive change in growth momentum" for the euro area and stable growth for Japan, the United Kingdom and India. However, for China, the United States and Canada they show an "easing growth" scenario. Globally, like the Purchasing Managers' Indexes, they let believe that the world economy grows at a moderate pace these days and that this trend will continue in the coming months.

Link to the OECD May 12 press release:

http://www.oecd.org/std/leading-indicators/composite-leading-indicators-cli-oecd-may-2015.htm

Link to the OECD May 12 press release:

http://www.oecd.org/std/leading-indicators/composite-leading-indicators-cli-oecd-may-2015.htm

Wednesday, May 6, 2015

World Economy : Moderate Growth

The J.P. Morgan Global Manufacturing & Services PMI recent evolution lets believe that the world economy is expanding at a moderate pace these days.

Link to Markit Economics May 6 press release:

http://www.markiteconomics.com/Survey/PressRelease.mvc/8554b240eda74a019242005c06c2b843

Link to Markit Economics May 6 press release:

http://www.markiteconomics.com/Survey/PressRelease.mvc/8554b240eda74a019242005c06c2b843

Thursday, February 12, 2015

Quebec economy: modest growth in the coming months

Desjardins Leading Index (DLI) showed little progress during last year fourth quarter. It points, at best, to a modest growth for Quebec's economy in the first half of this year.

Link to DLI analysis published February 12:

http://www.desjardins.com/ressources/pdf/ipd0215e.pdf?resVer=1423749038000

Link to DLI analysis published February 12:

http://www.desjardins.com/ressources/pdf/ipd0215e.pdf?resVer=1423749038000

Tuesday, February 10, 2015

World economy: is growth too comfortable at just over 3%?

The world economy seems comfortable at just over 3% of real growth. It is not a robust growth, but it is what we get in these years even if the monetary policies are still very accommodatives around the world. It grew by 3.3% in 2013 and 2014. In their respective economic outlook, published last January, the IMF and the World Bank forecast a world GDP (at PPP) growth of around 3.5% this year. It would be just slightly better than in previous years, although leading indicators of the evolution of the economy let believe, for the moment, that growth in the coming months could be less than that.

The OECD monthly leading indicators, published February 9, let anticipate a stable but modest pace of growth in the coming months. The Purchasing Manager Indexes, published by Markit Economics earlier this month, point towards a world growth that goes from modest to moderate early in this year.

The G-20 Finance Ministers and Central Bank Governors, at their meeting in Istanbul on February 9 and 10, insist on their preference for a much stronger growth, but they have few concrete solutions, except their usual reform agenda, to offer in a context where risks and uncertainties are still quite high.

To be optimistic: nothing lets believe that the world economy could contract or show a sharp decline of its growth rate in the near future. Even the euro area could avoid such a scenario, although deflation is still at its door with its potential for economic turbulence.

Link to the OECD February 9 press release:

http://www.oecd.org/fr/std/indicateurs-avances/indicateurscompositesavancesdelocde-miseajourfevrier2015.htm

Link to Markit Economics February 4 press release:

http://www.markiteconomics.com/Survey/PressRelease.mvc/aa9e75bbcfac4fea8622b22632b5d42c

The OECD monthly leading indicators, published February 9, let anticipate a stable but modest pace of growth in the coming months. The Purchasing Manager Indexes, published by Markit Economics earlier this month, point towards a world growth that goes from modest to moderate early in this year.

The G-20 Finance Ministers and Central Bank Governors, at their meeting in Istanbul on February 9 and 10, insist on their preference for a much stronger growth, but they have few concrete solutions, except their usual reform agenda, to offer in a context where risks and uncertainties are still quite high.

To be optimistic: nothing lets believe that the world economy could contract or show a sharp decline of its growth rate in the near future. Even the euro area could avoid such a scenario, although deflation is still at its door with its potential for economic turbulence.

Link to the OECD February 9 press release:

http://www.oecd.org/fr/std/indicateurs-avances/indicateurscompositesavancesdelocde-miseajourfevrier2015.htm

Link to Markit Economics February 4 press release:

http://www.markiteconomics.com/Survey/PressRelease.mvc/aa9e75bbcfac4fea8622b22632b5d42c

Monday, January 12, 2015

OECD leading indicators : no major change

The monthly leading indicators from the OECD, published January 12, do not show any major change of trend in the short term economic outlook for most of the countries.

Link to the OECD press release:

http://www.oecd.org/std/leading-indicators/CLI-Jan15.pdf

Link to the OECD press release:

http://www.oecd.org/std/leading-indicators/CLI-Jan15.pdf

Tuesday, January 6, 2015

World Economy: Growth Slowdown

The J.P. Morgan Global Manufacturing & Services PMI, published January 6, shows that the expansion of the world economy, was slowing down at the end of 2014. The recent evolution of the new orders subindex lets believe that this trend continues at the beginning of this year.

Link to Markit Economics press release:

http://www.markiteconomics.com/Survey/PressRelease.mvc/a0012184072a45c19d6ba4077f7c173d

Link to Markit Economics press release:

http://www.markiteconomics.com/Survey/PressRelease.mvc/a0012184072a45c19d6ba4077f7c173d

Subscribe to:

Posts (Atom)